Indexing is still a bet

Investing is often thought of as active or passive. Are you trying to beat the market (active), or are you just trying to earn the market return (passive)?

The most common way to passively invest is to "index" (ex: buying the S&P 500 index). It's hard to beat the market, so indexing is seen as the safer thing to do (and it is!).

But what many people who index don’t realize is even indexing is a bet. And however you set it up, you are still taking a view of some kind on the market. How you choose to index is an equally important question as choosing whether to be an active or passive investor.

I was reminded of this when I came across this tweet about the underperformance of Betterment when compared to the S&P 500. Betterment is a popular way to index, and I've been a customer since 2014.

My @Betterment portfolio performance over the last 10 years, compared to the S&P 500. S&P +237%, Betterment +101%

— Taylor Crane (@taykcrane) November 28, 2023

Is this an absolutely damning criticism of Betterment?

This seems incredibly disappointing to me but maybe I'm missing something? pic.twitter.com/VNS9ZtihS9

Why has the Betterment portfolio underperformed the S&P 500? You might think the answer is “bonds” given that Betterment often allocates a small percentage of the portfolio to them even if you are young, but this isn’t the main reason actually.

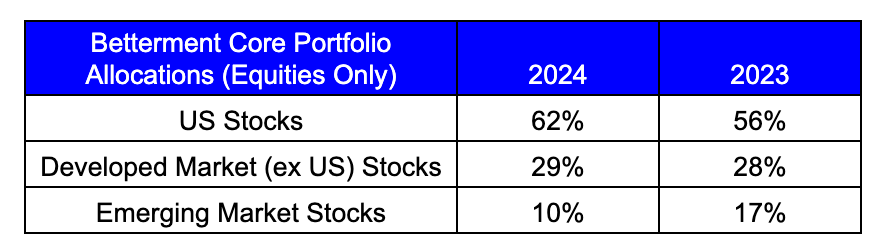

Instead, it’s because Betterment historically allocated >40% of the equity portfolio to Emerging Markets and Developed Markets (excluding US) equities (this is mostly Europe). These markets have both massively unperformed US equities since 2010 for a few reasons:

- Strong US economy and US tech boom, in contrast to anemic growth in Europe

- Strong USD against other currencies, reducing international returns for US investors

- Decline in commodity prices and political instability in EM

So the painful lesson for many here is this: if you passively invested by indexing with Betterment like I did in 2014, you weren’t just “buying the market”. You were in some ways making a bet that Europe and Emerging Markets would succeed in the next decade. You were making a bet that the US wouldn’t become a tech powerhouse and be the best performing market in the world. You were also making a bet against crypto, commodities and real estate, given the Betterment portfolio didn’t own any of those directly either. Clearly, indexing doesn’t absolve you from the more difficult question of asset allocation across your portfolio.

Should I put all my money in the S&P 500?

So if indexing is still taking a bet, what bet should you make today? It’s tempting to say, like many of the tweet replies, that you should just invest in the S&P 500 or Vanguard Total Stock Market Index (VTI) and call it a day. After all, it’s betting on what’s worked in the past 10 years.

But I’d caution against this approach and argue for diversification for two reasons.

Winners one decade can be losers next decade

First, it’s tough to predict which markets will outperform consistently and the winners one decade are often the losers the next. After all, this is the reason Betterment set up their portfolio in a diversified way in the first place. In the same way US markets outperformed since 2010, European and Emerging Markets had performed well in the preceding decades.

From 1988-2010, Emerging Market equities returned 11.2% annually vs only 9.8% for the S&P 500 (European stocks did decently at 6.6%). This equates to 11xing your money if you were in Emerging Market stocks for those 20+ years. From 2002 to 2010, you would have 5xed your money alone.

It is only with hindsight that we can see what the updated chart looks like (see below). But if you were thinking about setting up a long term portfolio when Betterment was founded, it would have been crazy at the time to not hold EM and developed market stocks. It would be like saying you should avoid tech stocks today.

So buying the S&P 500 alone today seems like the “safe” thing to do, but it’s still making a bet that what happened in the last decade will continue. And in general, this type of relative outperformance doesn’t hold consistently decade after decade.

US Equities are priced to perfection today

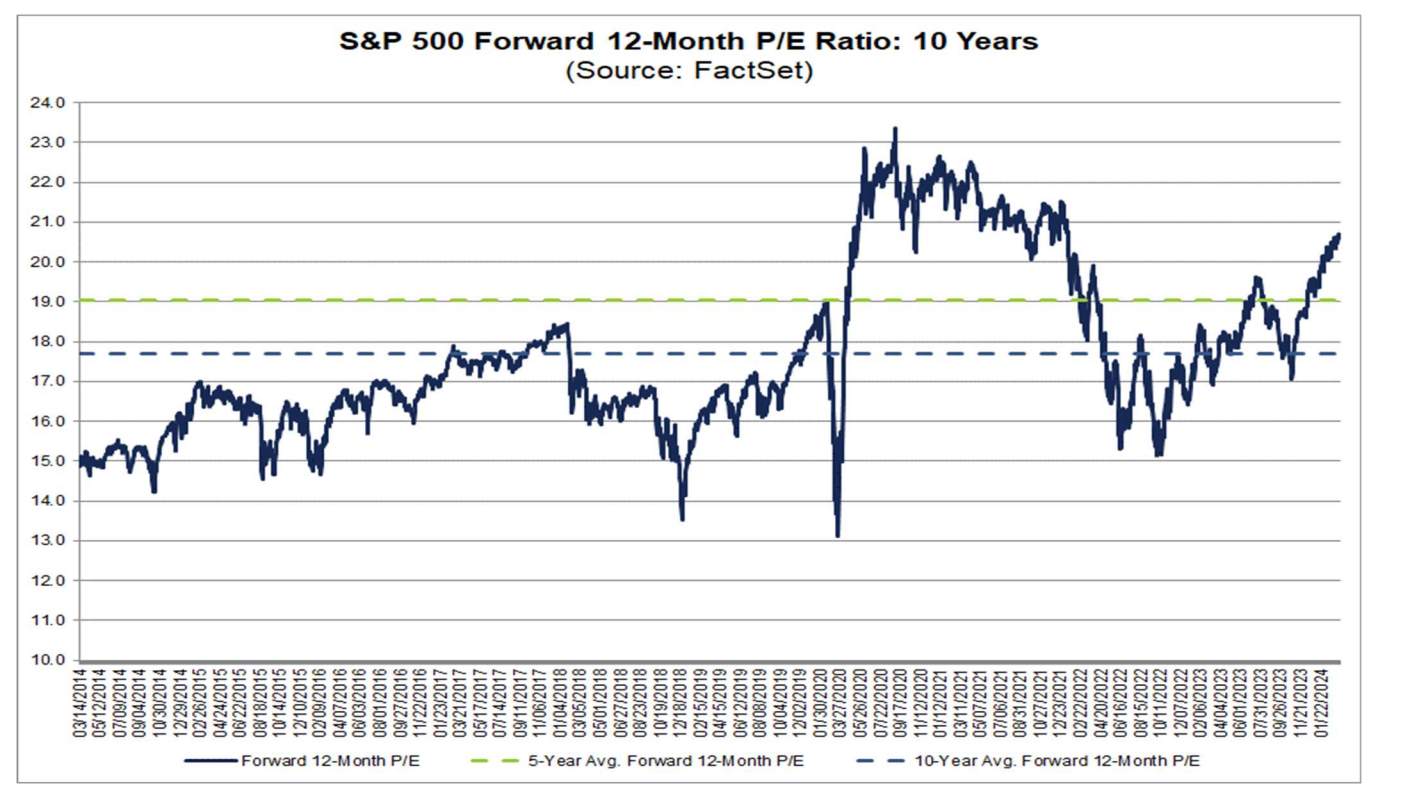

Second, more than just traditional diversification, the reason to not put all your money in the S&P 500 today is that valuations of US equities are at all time highs. As Jeremy Grantham put in a recent GMO piece:

Well, the U.S. is really enjoying itself if you go by stock prices. A Shiller P/E of 34 (as of March 1st) is in the top 1% of history. Total profits (as a percent of almost anything) are at near-record levels as well. Remember, if margins and multiples are both at record levels at the same time, it really is double counting and double jeopardy – for waiting somewhere in the future is another July 1982 or March 2009 with simultaneous record low multiples and badly depressed margins.

Now Grantham has famously held the view that there is better opportunity outside US equities for a long time (and lost money as a result), but he has a point. US equities are priced to perfection and price to earnings ratios (P/E) are getting close to the 2021 bubble territory.

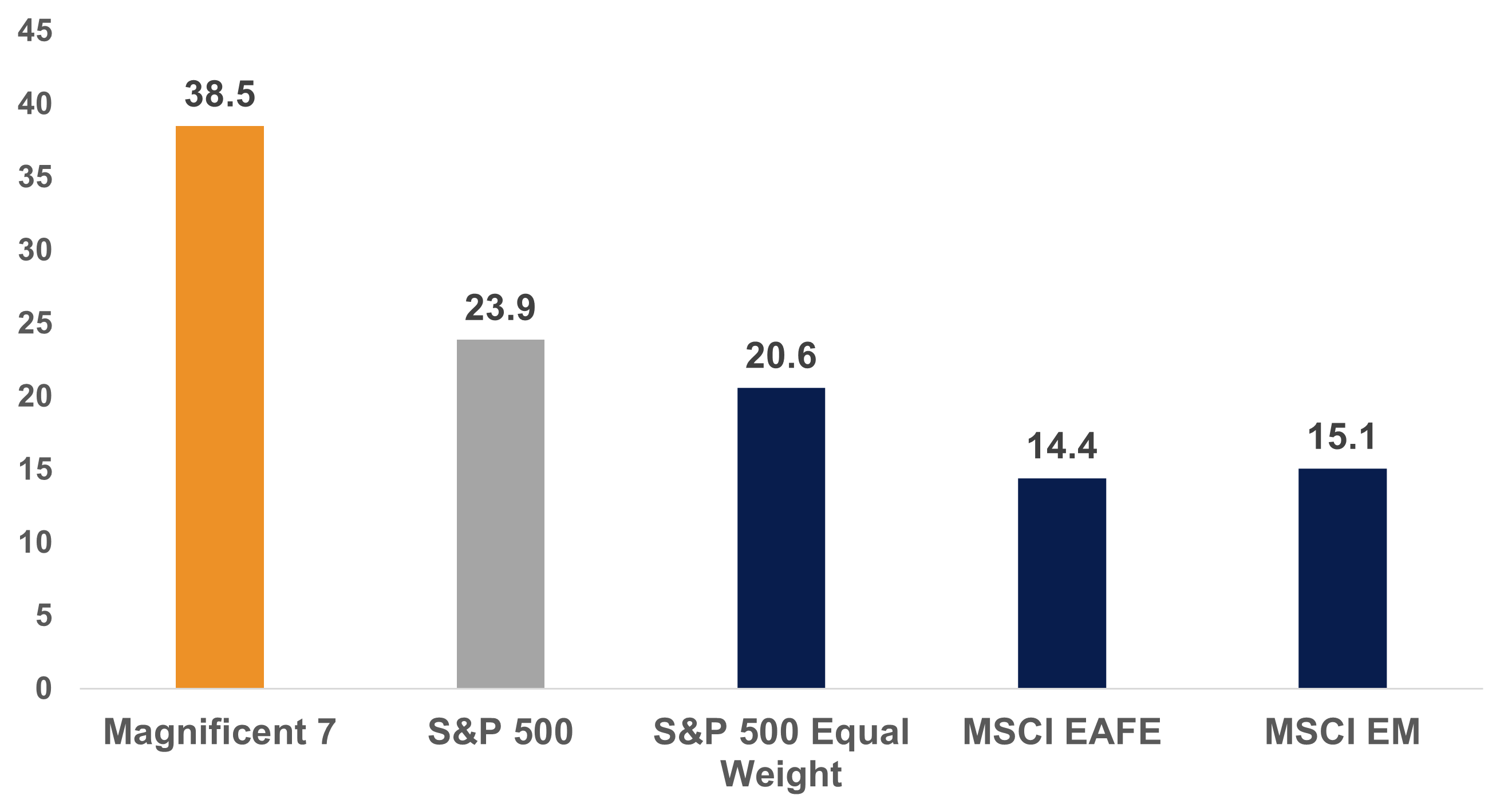

As many know already, this is being driven by the AI boom which have driven valuations higher for the "Magnificent 7" stocks (thus driving up the S&P 500 as a whole). Importantly, this has not had a similar effect on European (MSCI EAFE) or Emerging Markets (MSCI EM) stocks.

Of course, valuations are useless in the short term and high valuations are no guarantee of lower returns. But history shows that the longer your time horizon, the more they matter. This just adds to the reasons to be careful about assuming too much from the last decade plus of US equity outperformance.

That's how I feel at least. When it comes to your portfolio though, even if you index, it's for you to decide what bets you are willing to make.

Appendix

Ironically, Betterment just updated their portfolio to be more US focused (see below). They now allocate more to US stocks and less to EM stocks, and they also gave up on their value tilt! (2023, today). They list some reasons, but even they are essentially capitulating to the price action in the last decade and taking a “bet” that it will continue.